As usual in January, the IMM furniture fair in Cologne and the Domotex flooring show in Hamburg were key events for the European wood trade, providing a signal of market sentiment and an insight into emerging trends.

Official reports from both shows were typically bullish, implying a high level of underlying confidence in sophisticated and innovative European manufacturing sectors.

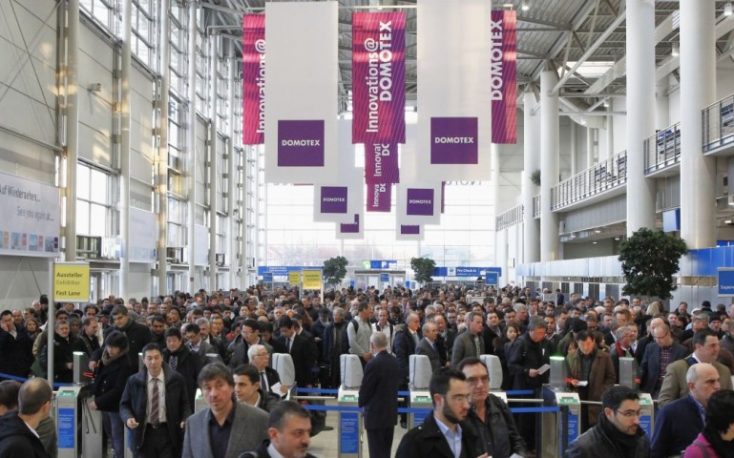

IMM Cologne reported 1,233 exhibitors from 53 countries and over 128,000 visitors, up from 125,000 the year before, with over 50% of the 82,000 trade visitors from overseas. Domotex reported 35,000 attendees, 70% of them from abroad, and over 1,400 exhibitors from more than 60 different nations.

An emphasis on “sustainability” has, of course, been a common theme running through these and similar shows in Europe now for several years. However, this year there was a sense that the environmental issue has become more urgent, that industry needs to move decisively beyond the greenwash and that failure to do so voluntarily will almost certainly lead to imposition of new taxes and regulations.

The intense focus on sustainability at the shows is not so surprising given the “Greta effect”, which is galvanising EU efforts to meet the goals of the Paris climate agreement, and the timing of the shows so soon after the launch of the new “Green Deal” by the European Commission which aims to make the EU climate neutral by 2050.

This policy initiative and associated design trends towards more authentic, natural and carbon neutral products, higher quality items that are more durable and less often replaced, and increasing interest in furniture that can be used interchangeably either inside or out of doors, all have clear and generally positive implications for wood product suppliers.

To some extent though, the sunny outlook portrayed in the publicity for these trade shows, flies in the face of economic and trade data which suggests that the European trade in both wood furniture and flooring products, which has never really recovered the dynamism of the years prior to the financial crises, was cooling again in 2019.

There is intense competition, which is certainly acting to spur innovation in some sectors, but the concern is always that wood manufacturers, particularly those dealing with solid hardwood, are falling behind in the R&D stakes.

There remains an almost overwhelming focus on the oaklook, a trend which extends even into artificial surfaces, which is damaging prospects for wider hardwood market development.

Leave a Reply