The EU’s Sustainable Tropical Timber Coalition held its annual conference in Paris on 26 September. The conference highlighted the ongoing work to promote tropical timber in Europe by STTC participants and raised questions about the role of targets for procurement of “certified sustainable” products that are central to STTC activities.

Over 55 Europe-based organisations are involved in the STTC, grouped in various categories according to their type and level of involvement as Partners, Participants and Supporters. All STTC participants are invited to “draft an Action Plan for activities that will increase market share of sustainably sourced timber from tropical forests”.

The underlying idea behind STTC is summarised on the organisations’ website: “The alliance of public and private sector and NGO backers behind the STTC is concerned that EU tropical sector’s shrinkage could on one hand ultimately deprive specifiers, end users and consumers of a technically high performance, diverse construction and manufacturing material. Critically, it could also disincentivise tropical suppliers from introducing sustainable forest management”.

The focus of the Paris Conference, attended by around 80 representatives of trade, NGOs and government, was on the “use of data to drive market share”. The question of market data was interpreted quite narrowly, focusing on the question of how to assess the share of certified and legally verified wood in total EU imports of tropical wood.

The share of tropical timber relative to other timber products and commodities was not addressed.

This focus was closely linked to the STTC Roadmap developed through consultation with STTC participants and which built on discussions at the previous 2017 annual conference in Aarhus.

At that meeting, the IDH, an organisation supported by the Dutch government to encourage sustainable trade in several commodities, announced extension of its financial support for STTC to 2020.

STTC has established a 2020 target “to increase European sustainably sourced tropical timber sales to 50% above 2013 levels”. To monitor progress, the IDH Roadmap supports publication of three annual report (2018, 2019, 2020) that on a European level will “make data available on market share of sustainable tropical timber, per country and per sector”.

A key source document to the STTC conference was the STTC report prepared by Probos, a Dutch consultancy and published in June this year which estimates the “current market share of verified sustainable tropical timber”. The key finding of this report was that an estimated 30% of primary tropical timber products placed on the EU market in 2016 met the STTC definition of “verified sustainable”.

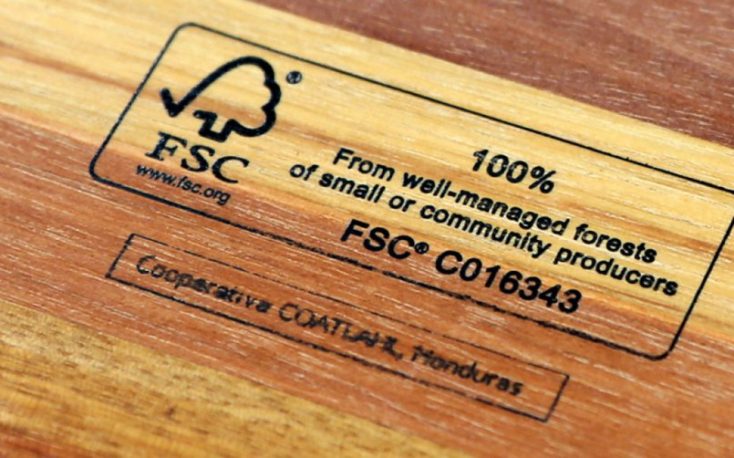

While the STTC report does not explicitly define “verified sustainable”, the measure of “share” is based on best available information on the quantity of FSC and PEFC certified timber placed on the European market relative to uncertified wood. This definition of “sustainable timber” aligns with government procurement policy in the Netherlands and Germany and which has been adopted in trade association codes in several European countries.

The STTC report also comments on the role of FLEGT licensing in relation to certification: “while not necessarily considered evidence of sustainability, FLEGT licensing is widely recognized as an important tool for promoting sustainable forest management. Most stakeholders in the sector would agree that a combination of certified operators and a FLEGT-based legal system provides the best assurance for sustainable forest management”.

The report also makes clear that the 30% estimate of EU certified wood in total tropical imports is only preliminary. The report notes that for the period when the report was prepared, survey data covering a large proportion of importers was only available in a limited number of European countries including Belgium, the Netherlands, Spain and the UK.

According to the report, the estimated share of certified in total tropical primary product imports (logs, sawnwood, veneer and plywood) varied widely between European countries.

A relatively high share is reported for the Netherlands (63%) and the UK (49%), but this falls to 20% in Germany, 12% in both Belgium and France, 5% in Italy and 4% in Spain. There was no data for the other two countries included in the survey, Denmark and Norway.

Leave a Reply